Russbroker Caribbean market review

A slow start to the year

Container market

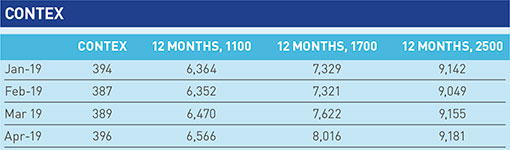

The traditional spring market upswing has started relatively late this year and the magnitude of rate increases has been very moderate. From the end of last year to the middle of April, the ConTex declined by about three per cent after increasing by 24 per cent and 35 per cent during the same periods in 2018 and 2017.

The 2,500 teu market has developed into a diverse market with three vessel types: standard, high reefer and modern eco. The basic ships and to, a large degree, the eco vessels are employed in intraregional feeder services, whereas most of the high reefer ships trade between the Americas and Europe, with some also catering to the fruit services between the Caribbean/Central America and the United States. The modern eco ships often provide the required number of reefer plugs, but their more economical engines lack the top speed demanded by many of the pure reefer cargo operators.

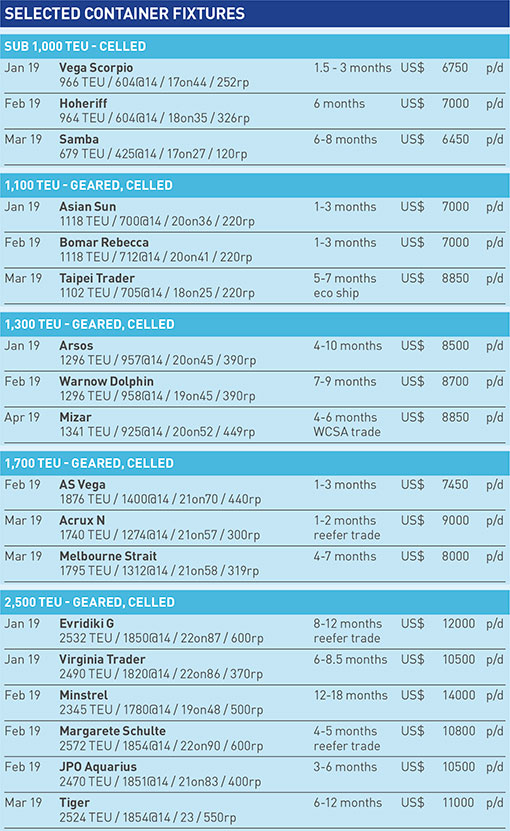

The greatest movement in earnings happened in the high reefer category, where rates declined to around US$ 11,000. Standard ships largely remained constant at mid US$ 10,000 levels and the eco types commanded rates of around US$ 14,000.

In a similar way to the other ship sizes, the 1,700 teu segment improved only slightly from US$ mid 7,000 to 8,000. Some extra premiums were achievable for Cuba or reefer trade. Despite the fact that more than 10 standard 1,700 teu ships had fallen into spot positions in Asia in early 2019, only one ship decided to position towards the Caribbean. A further two ships came from the Mediterranean, but overall tonnage balance was not affected as some ships left for cheaper docking options in Europe and Asia.

High reefer ships of 1,300 teu fixed about US$ mid 8,000 throughout the first couple months of the year. Improvement did not show much in the rates, but period flexibility became lower and thus moved in owners' favor. In Asia those ships struggled to find any employment and whenever business could be secured rates were as much as US$ 2,000 lower. Consequently one more ship positioned with new empty reefer containers ex China towards the Caribbean where it fixed consequent period business. As of mid April only two such ships are left in Asia and seven in the Mediterranean, while 23 such vessels are plying South and Central American waters.

In addition to the high reefer designs, two ‘regular’ 1,300 teu vessels came from Europe to replace two 1,700 teu ships in a Mexico-Cuba service.

The market for 1,100 teu tonnage, too, was unspectacular as earning levels stagnated around US$ 7,000. In this size range, also, there were often ships running into spot positions. Despite some ships leaving the area, the two carrier-owned newbuildings, which finally arrived at the beginning of the year, contributed to the slight oversupply.

In a rare move, one mainline carrier planned to open a new service with three 700 teu ships. As those ships have become scarce recently, only one such vessel could be sourced from the Caribbean, one had to be positioned from Europe and the third position was filled by an 1,100 teu ship. Charter rates for such tonnage are stable in the US$ mid 6,000 to 7,000 range.

Throughout all sizes, the Caribbean trade paid about US$ 1,000 more than in Europe or Asia. Owners, however, do also incur substantially higher operating expenses when chartering out their ships for pure Americas trade.

In addition to the higher rates, owners have a little more leverage as fewer liner-owned ships trade in the Caribbean than anywhere else in the world. Globally, 55 per cent of all ships of between 500 and 2,000 teu are charter ships, whereas in the Americas 76 per cent, 96 per cent and 82 per cent are chartered in the segments of 1,100 teu, 1,300 teu and 1,700 teu respectively.

The new terminals in Moin and Puerto Cortes have so far reached utilization levels of 50 per cent and 30 per cent. Despite the improved infrastructure now available, the largest ships which have called the new terminals so far had only nominal capacities of 3,800 teu and 2,500 teu. The new terminal in Moin also faced dramatic delays in early April due to roadworks.

Macroeconomics

The International Monetary Fund has revised its economic growth forecast downward for most areas of the world. The Americas, however, present a mixed picture. The US and Mexico are expected to fare worse than in 2018 with growth rates of 2.3 per cent and 1.6 per cent respectively. The Caribbean is also forecast to grow more slowly than last year, but with 3.6 per cent projected economic expansion for 2019 still depicts a strongly positive value. Both Central and South America are expected to fare better than last year with GDP growth figures of 3.2 per cent and 1.1 per cent.

On an individual country level, Brazil and Colombia are on an improving path, whereas the IMF predicts the economies of Venezuela, Argentina, Ecuador and Puerto Rico will shrink in 2019.

Global trade volumes are still estimated to grow at 3.4 per cent; this number, though, comes in below last year's value and is lower than the last estimate for 2019.

In theory, economic expansion is also positive for trade volumes; in the Americas, however, the correlation between GDP growth and teu throughput numbers was relatively low in 2018. The Dominican Republic, for example, posted the highest economic growth in the Caribbean, with over seven per cent, while teu throughput increased by ‘only’ 3.5 per cent. Colombia's economy, on the other hand, expanded by 2.7 per cent, whereas teu figures jumped by 16.2 per cent, resulting in a multiplier of factor six.

Even countries with very low growth posted container trade growth. This included Cuba, Ecuador and Puerto Rico, which posted growths of 5.3 per cent, 11.2 per cent and 17.2 per cent respectively despite registering a recession.

Overall teu throughput in 2018 for Central and South America grew by 7.7 per cent and in the Caribbean even by 12 per cent. The share of transshipment containers in the Caribbean reached 22 per cent.

In general, the Caribbean region's economy is very reliant on construction, tourism and natural resources. The OECD has even issued a warning to Colombia that, in order to sustain the country's positive development of the last decade, a shift towards manufacturing and more investment into research and development has to occur. At the moment, Colombia appears too dependent on natural resources, which constitute 80 per cent of its exports.

Venezuela is still caught in a political deadlock, resulting in a continued downward economic spiral. The decline in container trade seems to have bottomed out, though; compared with the end of last year, the country is still served by nine containerships in regular services. As of late, the number of ad hoc calls and the share of aid cargo were increasing, threatening a further reduction of the fleet calling regularly.

Contrary to the Brexit uncertainty in Europe, several Cariforum countries have already signed a continuity agreement with the UK which guarantees those countries continued tariff-free trade after an eventual Brexit. In 2017 trade between the UK and the region had been worth over US$ 3 billion, a lot of it revolving around agricultural exports.

Sale and purchase of container tonnage in Caribbean

The number of transactions directly related to vessels trading in the Americas was rather limited during the beginning of the year. One geared 700 teu ship and one gearless 500 teu ship were sold to Mediterranean-based end-users and consequently left the Caribbean trade. A 1,300 teu high reefer ship changed from German to Greek hands as the bank forced the sale of this ship.

In sync with relatively stable charter rates, ship prices have generally stagnated also. The number of sales candidates in the standard 1,100 teu and 1,700 teu segments, suitable for Caribbean trading, remains high.

Scrapping levels remained very high in the first four months of the year, with about 25 ships of up to 2,000 teu having been sold for recycling. Among those was another liner-owned, 1,700 teu B-170 type, the last of this design still trading on the South American West Coast.

Ten ships up to 2,000 teu have been delivered this year so far; however, all are either for Asian liner accounts or on long-term charter. Nothing really suitable for Caribbean trading has been ordered.