Russbroker Caribbean market review

Small ships lag behind in the recovery

Container Market

Covid-19 induced economic decline continued to pressure the container charter markets in the second quarter. By the middle of May, globally 524 ships with a combined 2.65 million TEU capacity were idle or undergoing scrubber retrofits. With the relaxation of lockdown measures, the worldwide demand for transportation picked up again and the number of idle ships fell to 264 ships or 1.2 million TEU total capacity.

The US had been an important driver behind this development with a historic annualized GDP decline of 33% in the second quarter and an expected recovery in the third quarter of about 20%. In sync with the economic activity, Far East to US TEU volumes fell to a low of 0.9 million TEU in March and then recovered to a strong 1.5 million TEU in June – a value higher than in January or a year ago.

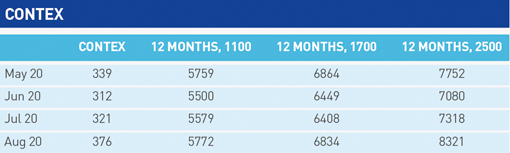

Container spot freight rates for the Asia-USWC route followed a similar path and almost trebled from around US$ 1,300 to a record high US$ 3,400 per FEU in August. The main benefactors of the rebound have however been the larger container vessels. The Contex, for example, reached its low point in the middle of June and since then the larger ships’ earnings improved up to the end of August considerably whereas smaller vessels barely made up any ground: 1,100 TEU, 1,700 TEU, 2,500 TEU, 2,700 TEU, 3,500 TEU, 4,250 TEU –that’s +8%, +15%, +28%, +33%, +43%, +90%.

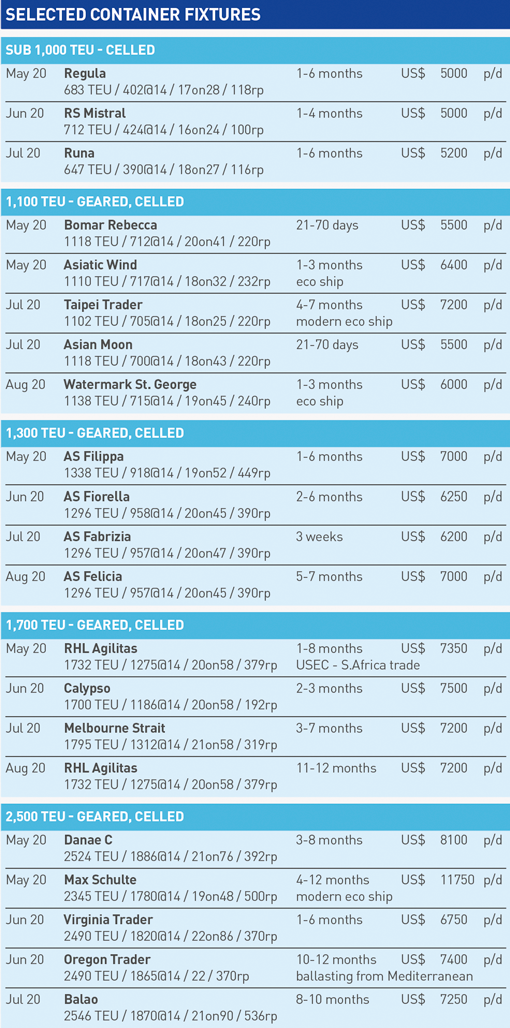

The 2,500 TEU geared category showed quiet a lot of activity during the last couple of months. Charter rates followed the general trend and decreased from about US$ 9,000 in April to levels under US$ 7,000 by the middle of June. By the end of August earnings had shot up again to just below US$ 9,000.

That the market was strongly in charterers’ favor until at least July showed the fact that one gearless 2,500 TEU ship had been looking for fresh employment for about four months since February and eventually had to position to Asia as nobody wanted to take on a gearless vessel in the Americas. On the other hand, several ships in this size ballasted from Europe to delivery into a charter in the Caribbean. One operator was particularly active and attracted three ships for a new service. Dry dockings for class renewals also caused a fair amount of ships going to Europe or Asia for cheaper yard options.

High reefer 2,500 TEU ships continue to lose their edge as one major fruit carrier received in August and September its first two fully reeferized container newbuildings, able to carrier over 600 reefer FEU. Those ships displaced an 1,800 TEU and a 2,500 TEU vessel and there are four more newbuildings scheduled which will likely replace further chartered container and conventional reefer tonnage. Worth noting is also that the modern eco SDARI types had to absorb some idle times and agree to flexible periods, as the relatively low bunker prices reduced their competitive advantage.

Charter rates for 1,700 TEU ships were relatively stable throughout the last four months. Most ships in this size range fixed in the low to mid US$ 7,000 levels but periods became longer and less flexible and rates are also expected to rise as both 2,500 TEU and 1,300 TEU were rate-wise on an upward trajectory by the end of August. In May and June two operators downsized their services from a 1,700 TEU to an 1,100 TEU scale which resulted in several redeliveries and close to ten ships looking for new business. By the beginning of August though the number of readily available ships in the size range of 1200 TEU to 2000 TEU had fallen to zero on the back of rebounding cargo volumes.

As mentioned above a few 1700 TEU high reefer ships have been already, or will be displaced by the fruit carrier’s newbuildings. Another influence on the supply side of 1,700 TEU vessels for the Americas has been the fact, that this year already 10 x 1,700 TEU ships have left the North European/Mediterranean trading area towards Asia and thereby reduced the pool of available ships for the Caribbean.

The 1,300 TEU high reefer segment experienced another dire period during the last four months. This size did not benefit from service downsizings as either ships were cut completely or operators jumped down several sizes and skipped the 1,300 TEU ships. As a result, up to five ships were spot in May and June. After two ships already left their preferred trading area another vessel fixed some empty containers to Northern Europe. Charter rates fell all the way to low USD 6,000 levels by July before the general recovery also helped those ships and charter rates climbed back up to 7000$ by August.

The 1,100 TEU size benefitted the most from the large fluctuations in cargo volumes. When the carriers scaled down services in May the excess 1,100 TEU tonnage was absorbed quickly. Charter rates however did not reflect the surge in demand and stayed at mid US$ 5,000 levels.

Just before the fixing frenzy another 1,100 TEU had left the Americas to start a new charter in West Africa. Similar to the fuel saving 2,500 TEU ships the eco SDARI 1100 ships also suffered from the high competition and low bunker prices as earnings fell from about US$ 9,000 in January to low US$ 7000 in July.

The movements in the sub 1,000 TEU category are becoming more and more erratic as the available charter fleet continues to shrink. One German tramp owner, in early summer, decided to move two of its unemployed 950 TEU ships from the Caribbean and one from the Mediterranean into cold lay up in Northern Europe. Another geared 700 TEU ship left towards the Mediterranean after being sold, leaving the Americas with only six charter ships in total. One carrier which had originally been looking for a geared 700 TEU ship in July eventually had to settle fixing a geared 850 TEU vessel which positioned from the Mediterranean. Another operator fixed, in August, a sister to the 950 TEU ships going into lay up out of a Mediterranean position and even provided some positioning cargo.

Noteworthy is also the movement of one 950 TEU ship specialized in carrying over-width and over-length containers from Northern Europe to the Caribbean. This ship is the 11th of this particular design now sailing in the Caribbean trading area. The last time such a vessel changed the side of the Atlantic was five years ago.

In terms of charter rates, the normal 850/950 TEU vessels fixed the same or even slightly better figures than the 1,100 TEU vessels with mid-to-high US$ 5,000 levels. Some 700 TEU geared ships were at extended at about US$ 5,000, around US$ 1,000 less than at the beginning of the year.

With the improving market conditions, from an owners’ point of view, the extreme period flexibility has been reduced to normal spreads of only about two to three months redelivery range throughout all ship sizes.

The number of port calls in the major Caribbean countries in 2020 did not change uniformly as many services underwent size and/or changes in port rotation. In Cuba, port calls of vessels smaller than 1,000 TEU increased at the cost of 1,300 TEU and 1,700 TEU ships as of April. Haïti registered a similar development with more sub-1,000 TEU ships in April and May before returning to early year levels again in June as then 1,100 TEU and 2,500 TEU figures picked up. Figures for Jamaica and the Dominican Republic proved more stable as the larger hub ports were not affected as much. In the Dominican Republic, though, the number of port calls of 1,700 TEU roughly doubled since June.

Macroeconomics

The world economy is slowly getting up on its feet again, in some countries faster than in others depending on how they have handled, and are handling, the Covid-19 crisis. The recovery however takes longer than predicted by the International Monetary Fund (IMF) who adjusted their June numbers drastically downwards compared to the ones published in April. Global growth/decline is now projected at minus 4.9% in 2020 and at positive 5.4% in 2021, 1.9 and 0.6 percentage points below the numbers from April, respectively.

World trade volume has been corrected downwards by 0.9 percentage points to minus 11.9% for 2020 and is expected to be 8% for 2021. Overall, this would leave 2021 GDP some 6.5 percentage points lower than in the pre-Covid-19 projections of January 2020.

In comparison to low-income developing countries Latin America and the Caribbean are being hit particularly hard. The IMF expects the GDP in this region to decline by 9.4% in 2020, 4.2% more than assumed in April. For comparison only, growth among low-income developing countries globally is projected at minus 1% in 2020.

A key factor for the below-average performance in this region is the dependency on tourism. The tourism share of the region's GDP is about 26%, exports of goods and services constitutes 42% and furthermore tourism accounts for 35% of employment in the Caribbean countries. So, no wonder that as tourist arrivals dropped by more than 50% in March and close to 100% in April simultaneously unemployment and poverty rates went up.

As shipping companies who are mainly operating in the Caribbean depend on the trade in this region they of course suffered from the extreme low level of exports and imports of goods. This was due to no tourists consuming goods and the consequent loss in revenues also effected the capacity to import goods. As a result of this situation some operators did not only redeliver chartered ships but even were unable to put parts of their own fleet to use.

However, some countries exports are more affected than others. Especially those which trade a lot with consumer goods and other dispensable products like for example Haïti. Clothes do not only account for about 85% of the nation’s exports but they also rely on the USA as main trade partner, with 83% of the exported products leaving for the States. In addition to the Covid-19 crisis, the Hurricane season is starting to pose another big threat to the Caribbean countries.

Sale and Purchase of Container Tonnage in the Caribbean

Prices for the typical Caribbean tonnage fell further in the aftermath of the Covid-19-induced demand crash. A 15-year-old Wenchong 1,700 type trading in the Mediterranean fetched only US$ 4 million and 15-year-old geared CV 1,100s went for around and about USD 2 million. Two German owners refinanced their Caribbean trading ships at historically low prices. A Zhejiang 950 vessel, trading in the Americas was sold to a tramp owner and one Greek owner added another CV 1,100 type ship, sailing in the Caribbean, to his growing fleet; now controlling 18 out of the 70 CV 1,100 charter ships.

One US operator also took advantage of the bank induced sell off and the rock bottom prices and purchased two 900 TEU vessels it has had on charter for many years already.

Another US liner company bought a 1,700 TEU ship from Northern Europe after acquiring two 700 TEU ships in the last couple of years. A sister ship just four years older on the other hand was sold for scrap to India after trading on charter in the Caribbean for only about one year.

The disagreement between lenders, owners and ship managers also caused a series of 2,800 TEU geared ships to be arrested. As a consequence, the two Caribbean trading ships lost their charter and one ship was sold at auction in the US. The remaining five vessels have all moved to Malta and are probably awaiting sale.

The sell off in the 700 TEU geared segment also continued with one ship in relatively poor condition being sold at auction in the Caribbean. After the sale to Turkish interests, the ships left towards the Mediterranean.

Issue 41: October 2020 - January 2021

-

From the CSA president, Juan Carlos Croston

-

Profile: Fernando L. Rivera

-

Profile: Milaika Capella Ras

-

CSA's first AGM

-

Past Caribbean Shipping Association AGM's

-

Past Presidents

-

A shipping life

-

Monica Silvera

-

Anchor Awards

-

Straddle Carrier

-

Electric tugs

-

Photo archive 2007 - 2019

-

Russbroker Caribbean market review

-

WFH by ADVANTUM