Russbroker Caribbean Market Review

Who thought it was possible?

Container Market

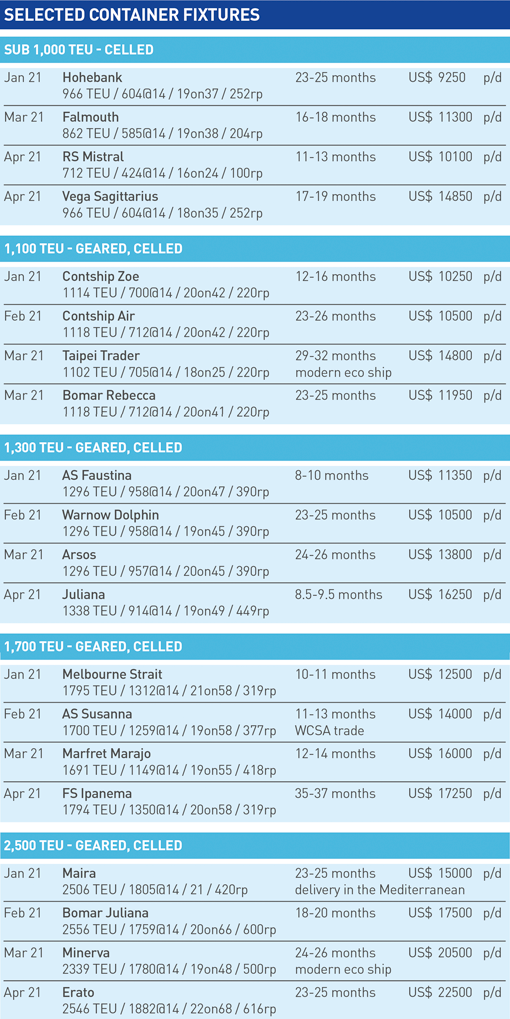

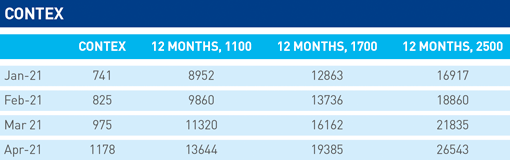

The container charter market has in 2021 so far only known one direction and that was up. Regardless of the vessels’ size, owners have been able to command higher rates with every fixture and absolute levels are closing in on all-time high figures last seen in 2005. The Contex, inaugurated in late 2007, has already exceeded its previous high from February 2008 by over 25%.

The extremely strong market is driven by solid cargo volumes combined with very low general efficiency. The Covid-19 crisis is still responsible for the shoreside labor shortage in many parts of the world, which leads to longer ports stays, congestion and consequently shipping capacity being bound by waiting time. By the spring of 2021, container equipment still remained in short supply, which forced operators to look at creative solutions at how to reposition boxes the quickest way to the highest paying freight market. An ageing fleet with more technical off-hire times also contributed to the capacity shortage.

As there were no vessels available on a spot basis or for short periods, operators are also having trouble covering gaps arising from the regular dry dockings the vessels have to undergo. The usual practice of just chartering in a replacement ship no longer works, and either schedules have to be scrambled in order to use vessels from other services or in some cases the cargo is just not being transported. For the Caribbean trades this problem is even more pronounced as due to cost reasons the large majority of owners prefer to dock their ships either in Europe or Asia. Factoring in four weeks of positioning voyages, ships are “gone” for almost two months. In 2021 almost 500 ships or about 17% of the total fleet between 500 and 3,000 TEU, have to go to dry dock for class renewal. Additionally, with many ships now also installing ballast water treatment systems, yard stay times are likely to be above average.

The overall market development has generally been shaped by a two-step process. First charter rates went up and then durations increased. With the higher rates many owners wanted to lock in their earnings for as long as possible. This led to discounts being granted for periods which were longer than the market norm. The Caribbean operators thereby led the way in the 1,100 TEU and to some degree in the 2,500 TEU segments by being among the first to fix two-year periods already in February. By the end of April barely any owner would accept periods for less than two years and for the larger ships sometimes even three years. Shorter periods were only available under special circumstances, when for example ships were slated to be sold or had to go to dry dock in the near future.

The sentiment among the carriers also turned this year. In January and February many were reluctant to fix tonnage too early as they were hoping for a rate correction, by March and April however the majority apparently did no longer believe in falling rates in the near future and rather extended their vessels early in order not lose them to the competition.

The rapid charter rate increases this year has also rendered the individual vessel’s technical specifications and exact geographic position less important. Normal disadvantages such as old age or poor fuel efficiency have almost disappeared when it came to rate differences and by April 2021 positioning voyages had become almost exclusively for charterers’ account.

The segment of 2,500 TEU vessels remains important for intra-Americas and Europe to Americas trade. About 10% of the fleet of 2,400 to 2,800 TEU geared ships trades in the Caribbean, US Gulf, North Coast South America area, another 10% sails in mainly reefer-heavy trades across the Atlantic and a further 5% of those ships are employed on the west coast of North, Central or South America.

Charter rates in this size were mainly driven by Asian demand. Despite the usually higher operating expenses in the Americas, rates generally lagged US$ 1,000 to 2,000 behind the ones achievable in Asia.

In the fall of 2020, a 2,500 TEU ship could still be had for around US$ 14,000. By January 2021 the rates had gone up to US$ 17,000 for one or US$ 15,000 for two-year periods. In March, rates crossed the US$ 20,000 barrier and by early April one ship fixed US$ 22,500 for 24 months Caribs trade. In Asia and the Mediterranean high US$ 20,000 had already been reached by late-April.

One ECSA operator of such tonnage decided to buy another ship rather than charter one, as owners had previously been oftentimes reluctant to trade their vessels off the coast of Brazil due to the long positioning voyage.

Another major carrier decided to add an extra North Europe to Central America loop mainly for reefer exports. By the end of April, a mix of 2,500 TEU geared, 2,800 TEU gearless and 3,500 TEU gearless vessels were employed in this service, illustrating the difficulty for charterers to source optimal tonnage.

In a normal market the introduction of six specialized, containerized newbuilding reefer vessels, able to carrier over 600 reefer containers, about equivalent to a 2,500 TEU ship, would have had a significant impact, but in this buoyant market the displaced vessels were quickly absorbed without denting rates.

Similar to the other vessel sizes the 1,700 TEU segment registered large earnings jumps as well. The year started of with 12 months being worth about US$ 12000 before rising to over US$ 15000 in March and up to US$ 18,000 by April. In this size category two ships were also fixed for 3 years and the last one only came at 4% discount compared to the previous two- year fixture.

Outstanding is also the fact that one fruit producer had to commit itself to an 1,800 TEU high reefer vessel for two years in order to secure the ship at all. This carrier in the past used to charter 1,300 TEU or 1,700 TEU ships only for a few months as cargo volumes fluctuate with the seasonal produce.

1300 TEU high reefer ships proved to be popular once again. After fixing already above US$ 10,000 in December, rates climbed to US$ mid-11000 by January and the first two-year period was concluded in February at US$ 10,500. In February, one Caribbean operator also added a 1,300 TEU ship to an existing service run with 1,100 TEU tonnage in order to increase frequency and capacity. By March 24-month periods could already be had for mid US$ 11,000 before the pace accelerated even more in April. Two year Caribs trade went for US$ 13500, then a sister fixed two years Mediterranean trade at US$ 16000 and another one achieved a remarkable US$ 20,000 plus rate for a short period of “only” one year. This development illustrated nicely that the traditional Caribbean trading premium is currently not measurable as rates simply rise day by day.

In the 1,100 TEU size category, the Caribbean globally led the way with the first two-year charters being fixed already back in February. Owners’ focus was first on long employment and only second on even higher rates. This was illustrated by standard 1,100 TEU ships all fixing mid US$ 10,000 levels – for six months in December 2020, 12 months in January and 24 months in February.

By the end of April such vessels had reached US$ 13,000 to 14000 for two years with eco tonnage US$ 2-3,000 above for even up to three years. In Asia earnings levels had gone even further with rates beyond US$ 15,000 for a regular CV 1,100 type.

As expected, the plans for a new Mexico service from a container shipping newcomer did not materialize as no vessels were available and whenever a ship did come open owners preferred to fix with the established players. The service, originally planned with two 1,100 TEU ships in January, was postponed to March, when the operator was also looking at 1,300 TEU or MPP tonnage. But by end of April no vessels had been chartered yet.

Charter rates for the smallest feeder vessels followed their larger sisters and also increased dramatically. A 700 TEU ship fixed over US$ 10,000 in April and some popular 800/900 TEU designs worked their way up from low US$ 9000 at the beginning of the year to almost US$ 15,000 by the end of April.

The fleet of small container ships continues to diminish rapidly as more and more vessels are being sold off. After grounding on the West coast of South America in October 2020 a 500 TEU container ship was deemed irreparable and sent to be broken up.

One 700 TEU geared ship, which had been sold in the fall of 2020, left the Caribbean islands trade in February at the end of its charter towards the Mediterranean. The same owner purchased another 700 TEU geared ship in February this year. The vessel is still trading for a major operator in the Caribbean until the summer this year and then will most likely also sail towards Europe. A further two 700 TEU gearless vessels are also likely to leave the Americas trading area soon, as they have been sold to European owners who will probably employ them in their own non-container trade. All those developments leave less then 10 sub 800 TEU charter vessels in the Caribbean.

Despite the very high charter rates only a very limited number of multipurpose vessels is being employed in pure container trades. A relatively high number of individual cargo consignments have been shipped on MPPs in 2021 so far but most container operators shy away from using such vessels in regular services. The reasons have been the costs for sourcing container lashing material, slow vessel speeds and longer port turnaround times due to missing cell guides. Some container terminals are even completely refusing to handle non-celled tonnage as labor for lashing is already in short supply.

Macroeconomics

Despite all the Corona setbacks the last global economic forecasts have been more positive than at the end of 2020. In its latest outlook the IMF expects global GDP to expand by 6% in 2021 after it contracted by 3.3% in 2020. World trade forecast are not as optimistic as an 8.4% growth in 2021 would not fully recover the 8.5% decline in 2020.

For Latin America and the Caribbean, the outlook however is far worse as this year the expected expansion will only be 4.6% versus last years strong contraction of 7%. In contrast the US for example, an important trading partner for many Caribbean countries is forecasted to post GDP growth figures of -3.5% and 6.4%. Central America and the Caribbean individually are below the average with -7.2% and 5.6% and -4.3% and 3.3% respectively.

Some experts are also afraid that the rise in poverty and consequent decline in education could have a negative long-term effect for some Caribbean and Central American nations.

Overall, access to vaccines and the pace of vaccinations will make a relatively larger difference to the Caribbean compared to other parts of the world due to their high dependency on tourism. In general, a normalization of the health situation is expected to give a stronger boost to the consumption of services such as travel and leisure activities than the consumption of physical goods. As a consequence, globally not a lot of extra cargo volumes are to be expected except for the Caribbean where a high share of the goods consumed by tourists have to be imported. In Jamaica for example the hotel and restaurant sector contracted by -53% in Q4 2020 compared to one year ago, whereas manufacturing only shrank by a minuscule 0.4%.

Sale & Purchase of container tonnage in the Caribbean

After the sale and purchase market picked up at the end of 2020, activity has increased even more with the rise in charter and vessel values. Many owners have withdrawn tonnage previously been offered as very lucrative charters could be fixed. Other owners on the other hand have been tempted to offload tonnage at increased prices and especially the ship financing banks wanting to exit the segment have recently used the opportunity to reduce their balance sheets.

During the first four months of 2021 over 150 container ships have already been sold. Of those ships roughly half went to end-users as they tied to hedge against ever rising charter rates.

Sales price, also for smaller feeder vessels, have risen sharply. Compared to one year ago 1,700 and 2,500/2,800 TEU tonnage achieved over 50% more by April 2021. In the Panamax-sizes the jump has been even more extreme with prices more than doubling on a year-on-year basis.

Instead of paying high prices for older second-hand tonnage, newbuildings are becoming more attractive for some operators. Especially as charter periods being asked for by owners are becoming ever longer the relative risk of committing to newbuildings is shrinking.

Newbuilding slots in China are however getting scarce with just a few places left for 2023, the majority being offered is already for second half 2024.

Two of the popular Zhejiang 950 designs changed hands, one going to a European charter owner and one going to a big liner operator.

Two very high reefer, gearless 2,800 TEU ships, which had been trading for one of the US fruit producers for several years were sold to a tramp owner and ended their charters. One of the vessels remains in the area and now trades between Panama and the Amazon while the other left towards the Mediterranean.

End users operating in the Caribbean also bought a 1,700 TEU and a 2,500 TEU vessel. As tonnage availability is shrinking every day due to the long-term fixtures, there are very few Americas-suitable newbuildings in the pipeline and carriers are buying up a relatively large share of second-hand tonnage therefore we expect charter rates for Americas-trading tonnage to remain very stable in the near future.